Voxeljet AG has announced its agreement to sell its entire business to funds affiliated with Anzu Partners LLC. The deal, structured as an asset transaction, is expected to close in March or April 2025, pending customary conditions including shareholder approval and foreign investment clearance in Germany.

Strengthening Voxeljet’s Market Position

The acquisition signals Anzu Partners’ commitment to sustaining and growing Voxeljet’s legacy. Whitney Haring-Smith, Managing Partner at Anzu Partners, will assume the role of chair of the Board of Directors post-transaction, with Voxeljet’s current CEO, Rudolf Franz, leading the operational business.

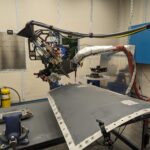

“Voxeljet’s innovative technology, from the largest 3D printers to intricate detailing capabilities, positions it as a leader in scalable additive manufacturing,” said Haring-Smith. “Its contributions to localizing supply chains and supporting circular economies align with the future we want to build.”

Rudolf Franz shared his optimism, emphasizing the synergy between Voxeljet’s industrial expertise and Anzu’s technological and financial resources. “With over 25 years of pioneering advancements in industrial 3D printing, this partnership ensures we remain competitive in a rapidly evolving industry,” Franz stated.

Deal Details and Go-Shop Period

The enterprise value of the transaction is approximately €20,033,000, with liabilities assumed by Anzu Partners and a cash component of €1.7 million. The agreement includes a “go-shop” period, active until January 12, 2025, allowing Voxeljet to solicit alternative acquisition proposals. If a superior offer is received, Voxeljet retains the right to terminate the current agreement and pursue the new proposal.

Shareholders will vote on the transaction during Voxeljet’s General Meeting in Q1 2025. If approved, Voxeljet plans to liquidate the company following the transaction’s closure.